Multi Claim Protection Cover

A new form of serious illness cover was launched by Royal London in 2019, and in most cases, I find it more suitable than traditional serious illness cover.

Why I like Multi-Claim Protection Cover:

It will pay out multiple times over the term of the policy.

The amount of cover you take out is like a “pot” and when payments are made, the money in the pot reduces and remains payable for future claims.

Whats more, if you require further treatment for the same condition, you can make another claim.

Claims are not held to specific illness definitions.

Claims are made based on treatment, if you need chemotherapy, the type of cancer does not matter.

Children are automatically covered, and claims on their cover does not reduce the parent’s cover.

Children are covered as a percentage of your cover with a cap of €25,000 at no additional cost -their cover comes standard and does not reduce your cover, they have their own “pot”.

Many major health scares are covered that would not be covered on a traditional serious illness contract.

(psychiatric care, injury requiring an ICU stay of 48 hours or more)

Your cover is payable as life cover should you pass.

If you were to live a healthy life and pass suddenly in a tragic accident, the cover is paid to your estate/next of kin as life cover.

The premium is locked and making a claim will not cause an increase in your payments.

Making a claim (or multiple claims), does not change the premium.

Case Study:

Sarah aged 30 takes out a multi claim policy for €100,000 in cover.

The premium (based on rates as of 30/06/2020) is just €35.54 to cover her to age 65.

Sarah is diagnosed with cancer at age 42 and requires surgery, chemotherapy and radiotherapy, she will receive €50,000.

She recovers and at age 55 Sarah has a stroke, she will receive another €30,000.

Sarah will then still have €20,000 left payable on any further health complications or death.

Sarah’s premium payments remain just €35.54 for the entire 35 year term of her policy.

Are there any cons?

The terms and conditions offer broad, practical cover, the only con to be mentioned is that the policy’s maximum age for cover is 69 and traditional serious illness cover is offered to age 74.

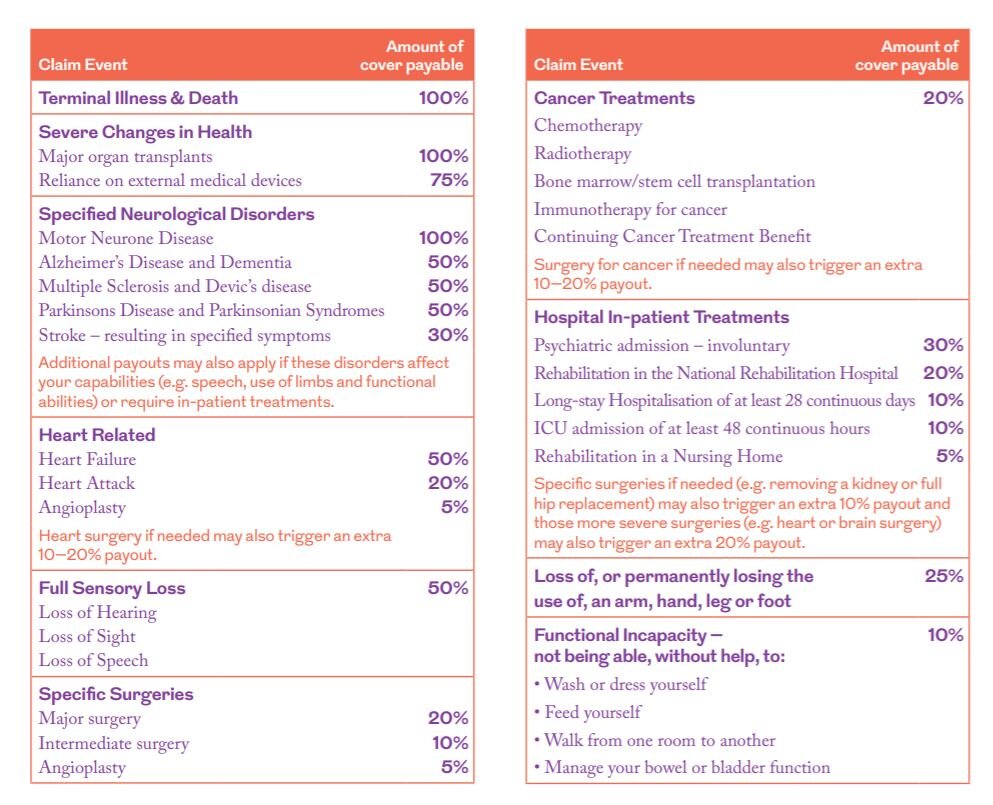

How are the payments determined?

The payments are based on severity and are a percentage of your total cover.

The full policy brochure is here.

If you do not have serious illness cover in place, I recommend considering a multi-claim protection policy.

Having a plan in place can make a tremendous impact on your recovery.

As always, you must balance need with budget and some cover is better than none.

Questions? Contact me anytime.

Rachel O’ Shea, Protection Manager