Life Company Spotlight: New Ireland

This is week 3 of our 5 week series where I highlight our favourite features offered by each life company. For impartiality, I’m writing in alphabetical order. (Aviva, Irish Life, New Ireland, Royal London & Zurich) It is important to note, some features are more impactful than others, some come with additional costs and some are standard policy features. For detailed information, send me a message anytime.

Notable features offered by New Ireland:

New Ireland offer a number of other beneficial features, the below are benefits not offered by other providers.

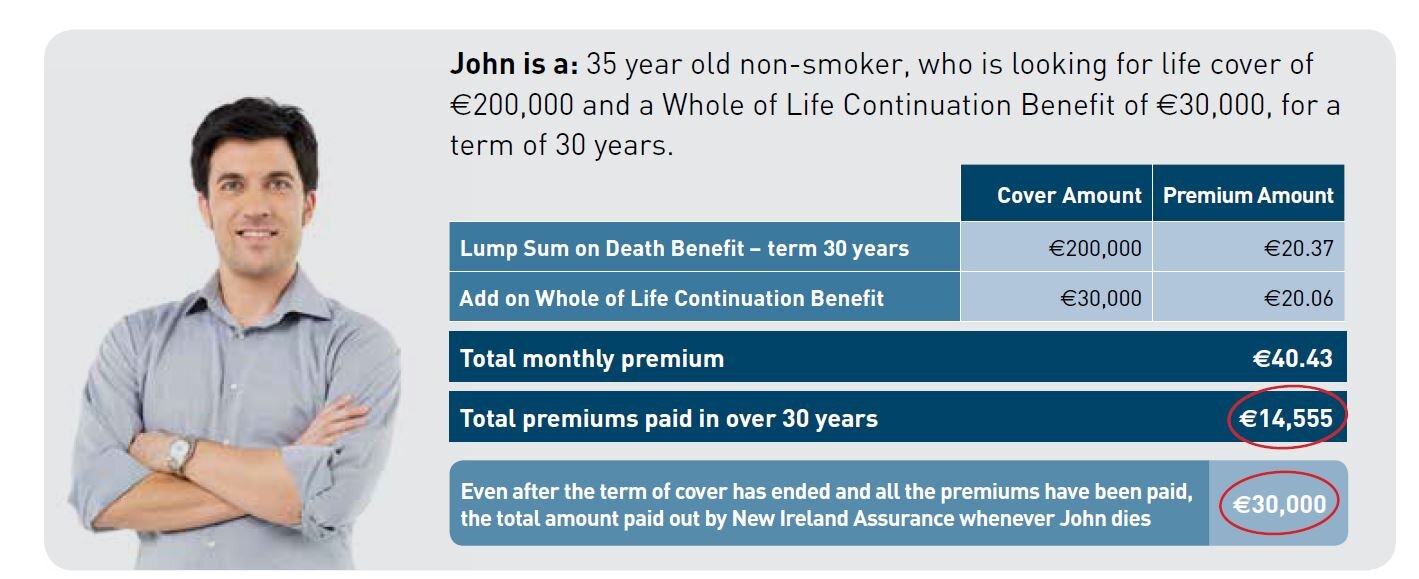

Whole of Life Continuation Benefit: This is a feature that you must select and pay for at the onset of your policy (completely different to Irish Life’s option to convert your policy to whole of life). With New Ireland’s whole of life continuation, you can add a whole of life “rider” to your term policy, at the term end, payments cease while the whole of life cover continues for the rest of your life. In the example below, if John were to die during the 30 year term, €330,000 is paid to his next of kin, any time after year 30, €30,000 is paid. Full details here.

Confirmed Income Option: This is a fantastic benefit to any one self employed who may have fluctuating income. On all other income protection plans, you state your regular annual income and no proof is required until a claim arises -the life company will then pay your benefit based on your actual income at the time of the claim. With the New Ireland confirmed income option, you can submit your proof of income upfront to lock your benefit, the life company will then base any claim on the information provided upon application and will not ask for income statements at the time of a claim.

Level Indexation: While all providers in the market offer policy indexation, (where your benefit and premium increase a small percentage each year to keep with inflation) New Ireland is the only provider who allows the benefit and premium to increase at the same percentage (currently 3% each). All other market providers charge a 4% or 4.5% increase in premium for a 3% increase in benefit. This is a small but impactful difference over the term of a policy.

Any queries on the above or have interest in securing an New Ireland policy? Feel free to call or email me anytime.

Rachel O’Shea, Protection Manager.