Life Company Spotlight: Royal London

This is week 4 of our 5 week series where I highlight our favourite features offered by each life company. For impartiality, I’m writing in alphabetical order. (Aviva, Irish Life, New Ireland, Royal London & Zurich) It is important to note, some features are more impactful than others, some come with additional costs and some are standard policy features. For detailed information, send me a message anytime.

Notable features offered by Royal London:

Separation of Cover: On a joint life or dual life policy, Royal London allow the insured parties to split their one policy into two separate policies should they separate/divorce. This feature is not one to plan for but offers significant benefit during an already difficult time.

Multi Claim Protection Cover (MCPC): I’ve written an entire blog on this product by Royal London. MCPC broadens illness cover by paying upon treatment required (such as chemotherapy, ICU stay, rehabilitation) providing cover for rare/obscure illnesses that would not be named on a traditional serious illness contract. In addition, psychiatric and accident related claims can be made, which are not covered on a traditional illness product. Brochure here with full details. No other life company in Ireland has an offering of this type.

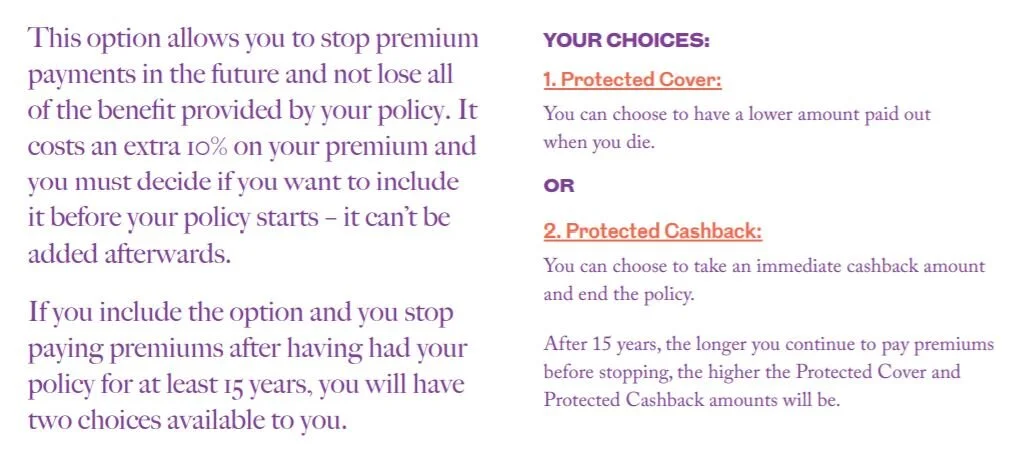

Life Changes Option: The “life changes” option is a feature that you can add to Royal London’s guaranteed whole of life policy that provides guaranteed encashment after the policy is in force for 15 years. Many people use whole of life cover to avail of Section 72 inheritance tax relief, having an encashment option allows people flexibility should tax laws or inheritance values fluctuate. In addition, the “life changes” option enables the customer to know from inception the most they will ever pay into the policy as Royal London will consider the policy “paid up” at the customer’s 100th birthday -ceasing premium payments while continuing their cover in full. I cannot recommend this feature enough. Brochure with full policy details here.

Their overall product suite: There are a number of features that Royal London offer alongside of other companies that aren’t necessarily “market leading” -the notable part is that they don’t take one feature away to offer another feature. For example: A few of the providers strip away guaranteed insurability and parental respite cover in their mortgage protection policies in order to offer competitive pricing -something a buyer wouldn’t know to look for. Royal London includes these as standard. Product offerings change regularly as life companies compete and receive client feedback, at the moment Royal London is leading. With that said, there are specific instances where other providers will be more appropriate for a customer, I am speaking in general terms.

Queries, feedback, or want to secure a Royal London policy? Contact me anytime.

021 4521328 roshea@olearylife.ie

Rachel O’ Shea, Protection Manager.