Bouncing Stock Markets

Why Stock Markets are bouncing

Our last blog on markets discussed staying the course through volatility. This week, we discuss said volatility.

It has been a pretty eventful 9 weeks, from the perspective of Global Stock Markets, with numerous records being broken on an almost weekly basis.

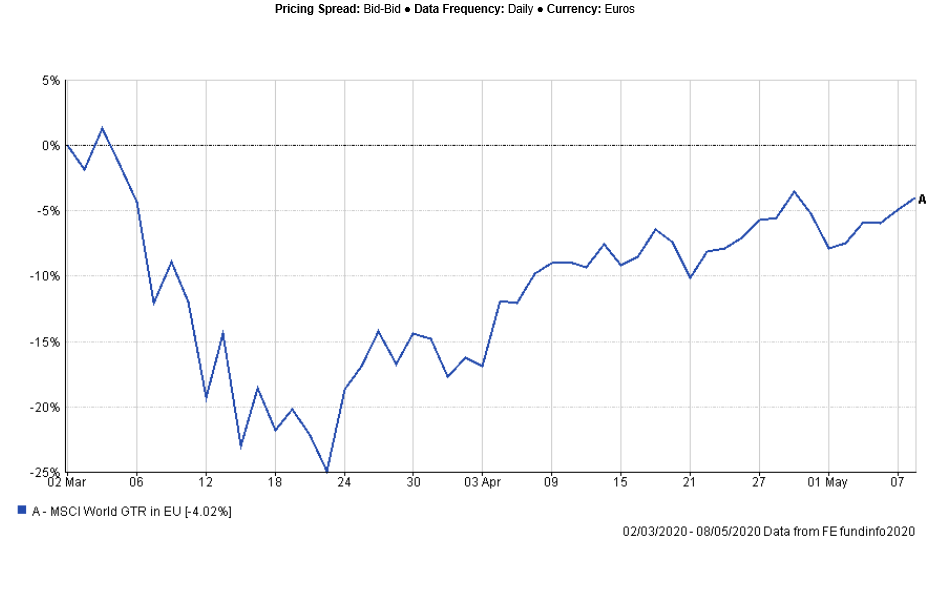

First, we endured the sharpest-fastest decline in history, with the MSCI World Index declining by almost 30% in a little over 2 weeks in March! Since then, April gifted Global Stock Markets their best month since 1987, and we now stand at a point whereby, notwithstanding the unprecedented volatility, the MSCI World Index is down only 4% since this all began.

(See Graph Below)

Many investors are increasingly puzzled by the continuing disconnect between economic data and the performance of equities. The supportive measures of global central banks and other policymakers has been one of the main proponents of this divergence.

Furthermore, significant positivity continues to pertain to the tech sector.

The next iteration of the economy will have its winners and losers with many market participants adhering to the idea that companies who have exposure to “Work from home”, “Play from home” and “Deliver to home” are well placed to be the big winners. This remains to be seen however, particularly against a backdrop of exceptionally poor economic data !

We firmly believe there is more to run on this story and significant stock market volatility is therefore extremely likely to remain ever present for the foreseeable future !

MSCI World Index – March 2nd – May 8th 2020

Author: Ronan Goggin, B.A. Fin ACSI Managing Director

Direct Dial: 021-4521325 | E: rgoggin@olearylife.ie