Cohabiting Couples and Inheritance Tax

Revenue allows a married person to inherit the entirety of their spouse’s estate free of tax, the same is not true for cohabiting couples.

Revenue view cohabiting couples as strangers when considering inheritance tax, this means that any amount over €16,250 that is inherited is subject to 33% taxation. The surviving partner is often left with a large tax bill. You can find tax thresholds and rules around inheritance tax also known as, CAT (capital acquisitions tax). Revenue.ie here

If a cohabiting couple jointly purchase a home valued at €400,000, and one partner passes, the other partner inherits €200,000 (1/2 the value of the home), the surviving partner is then left with a €60,637 tax bill, payable to Revenue.

There are a handful of ways to reduce, fund or eliminate this tax bill. It is important to take the time to consider inheritance tax when purchasing a home or starting a family -this is also a time when a will should be considered. Without a will a cohabiting partner may not be entitled to their partner’s assets.

Life insurance is one way to ensure your partner is not left with a tax bill they cannot pay. Life insurance policies start at just €10 per month, the biggest hurdle is the lack of awareness; people often do not realise the potential bill they could face or perhaps do not consider the value of the family home. I often talk to unmarried couples with children, a family home and substantial savings that have never been advised on this subject.

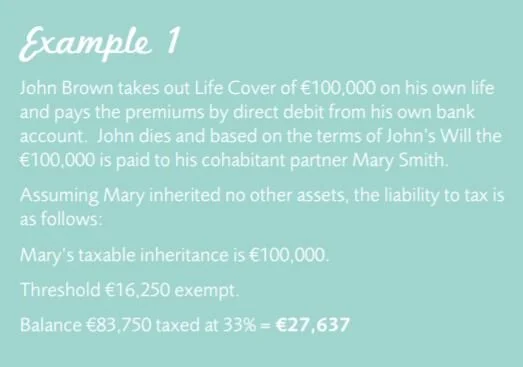

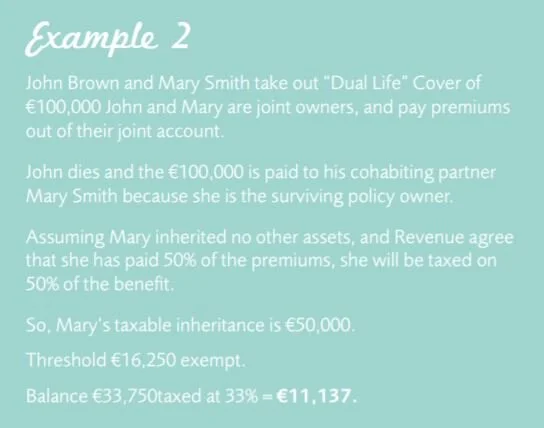

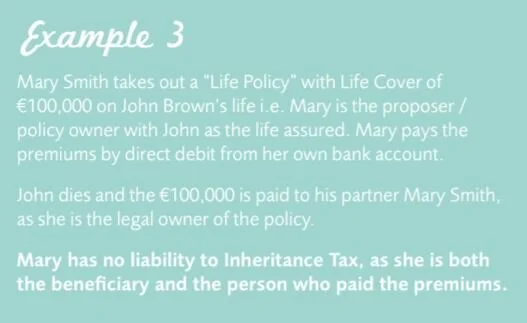

Below details how a tax bill would arise in various situations.

In example 1, no provision has been made and the partner is left with the largest tax bill. In example 2, paying the premium on a dual life policy from a joint account allows the remaining partner to substantially reduce the tax bill. In the last example two policies would need to be set up, one for each partner, eliminating any tax bill from the family home.

There are a handful of exemptions that you may qualify for, having the conversation with your advisor is key to knowing if you are prepared in the event of the unexpected.

A simple re-structure of the cover you have in place OR effecting a new policy is an inexpensive way to avoid an unnecessary burden.

If you hold substantial assets, a “Section 72” policy may be more appropriate, read further on same here.

If you want to talk about your potential tax liability and the (simple) solutions available to you, contact me anytime. Again, with policies starting at just €10 per month, don’t avoid the topic over (pressumed) cost.

Rachel O’Shea, Senior Consultant & Protection Manager